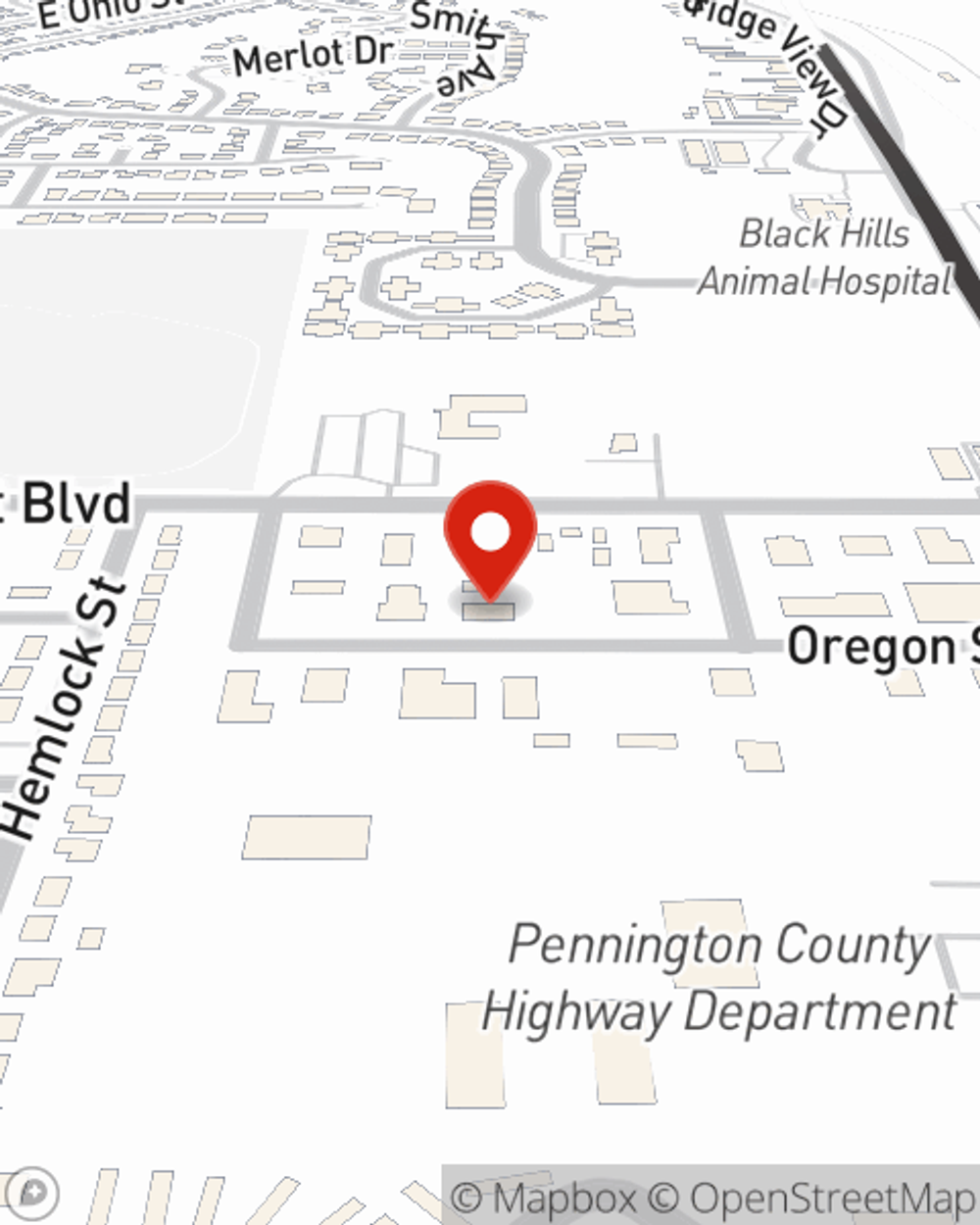

Homeowners Insurance in and around Rapid City

Looking for homeowners insurance in Rapid City?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- Rapid City

- Black Hills

- South Dakota

- North Dakota

- Nebraska

- Montana

- Wyoming

- Pennington County

- Meade County

- Lawrence County

- Custer County

- Fall River County

- Jackson County

- Haakon County

- Sturgis

- Spearfish

- Box Elder

- Custer

- Hot Springs

- Hill City

- Hermosa

- Deadwood

- Lead

- Belle Fourche

Insure Your Home With State Farm's Homeowners Insurance

There's truly no place like home. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, the trusted name for homeowners insurance. State Farm Agent Bruce Kitterman is your knowledgeable authority who can offer coverage options personalized for your precise needs.

Looking for homeowners insurance in Rapid City?

Apply for homeowners insurance with State Farm

Homeowners Insurance You Can Trust

Bruce Kitterman will help you feel right at home by getting you set up with dependable insurance that fits your needs. State Farm's homeowners insurance not only covers the structure of your home, but can also protect valuable items like your family cookbook.

Don’t let worries about your home stress you out! Get in touch with State Farm Agent Bruce Kitterman today and learn more about the advantages of State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Bruce at (605) 348-2525 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Wildfire safety tips: What to do before and after a wildfire

Wildfire safety tips: What to do before and after a wildfire

Learn essential wildfire safety tips to help protect your family and property. Discover how to prepare for wildfires and recover safely afterward.

Pressure washer safety tips

Pressure washer safety tips

You've got a big mess, but before you set the power washer to blast, take time to learn a few tips that might help prevent damage to what you are washing.

Bruce Kitterman

State Farm® Insurance AgentSimple Insights®

Wildfire safety tips: What to do before and after a wildfire

Wildfire safety tips: What to do before and after a wildfire

Learn essential wildfire safety tips to help protect your family and property. Discover how to prepare for wildfires and recover safely afterward.

Pressure washer safety tips

Pressure washer safety tips

You've got a big mess, but before you set the power washer to blast, take time to learn a few tips that might help prevent damage to what you are washing.